How Malware takes remote control of your HP after you download 3rd party apps

Prime Minister (PM) Lee Hsien Loong appears to be promoting a crypto-trading video on the Beijing-based news outlet China Global Television Network (CGTN). Yes, PM Lee seems to be discussing the benefits of a hands-free crypto trading platform, which boasts the ability to compute algorithms, analyse market trends, make strategic investment decisions, and execute trades—all autonomously, without any manual input from the user.

On 29 Dec, PM Lee shared a recent deepfake video that has been circulating online. Elaborating on the type of scam involved, PM Lee explained that scammers employ AI (artificial intelligence) technology to mimic our voices and images. They transform real footage of us, taken from official events, into very convincing but entirely bogus videos of us purportedly saying things we have never said. PM Lee urged people not to respond to such scam videos, which promise guaranteed returns on investments.

DEEPFAKE VIDEO OF DPM LAWRENCE WONG SELLING SOME INVESTMENT SCAM

Deepfakes are media that have been altered by AI to look or sound like someone. In the video, DPM Wong’s mouth is altered to synchronise with a fake voiceover that sounds like him. Yes, the voiceover mimics the pitch and intonation of DPM Wong’s actual voice. Don’t believe me? You can watch the deepfake video here.

Notably, the video was made from modified footage of DPM Wong giving an interview recorded by The Straits Times. The deepfake video promotes an investment scam, even using terms reminiscent of a DPM speech, like “my dear Singaporeans”.

Spate of Online Scams

Ms Jacqueline Khoo, 58, lost $44,487 from two credit card accounts and three bank savings accounts from POSB in a few hours after she clicked on a link to download a third-party app, following which scammers then increased her credit limits and siphoned out her money. Ms Khoo had chanced upon a Facebook advertisement for grouper fillets from a seafood supplier called “Fresh Market TGS” on Aug 25.

She was attracted by a deal that offered $10 grouper fillet with free shipping and contacted the seller on Facebook. “Although I never bought anything from Facebook before, I had previously bought fish and pork from Shopee and Qoo10. I was not suspicious of the ad and it never occurred to me that this was a scam,” she told The Straits Times.

New scam? Man pretends to be hit by car in Serangoon

What a dramatic accident — except that there was no collision involved. A man was caught on camera throwing himself out in front of an oncoming car and then falling onto the ground even though the vehicle did not hit him.

Several readers alerted Stomp to the video that has been circulating online since Wednesday (Sept 28). The incident reportedly occurred along Serangoon North Avenue 5 on Monday evening. In the video, the pedestrian is seen flinging himself onto the road in an exaggerated tumble.

The driver who captured the video, however, had honked and stopped in time while still some distance away from the man. She can be heard saying, "What are you doing?" It is unclear what the man replied but he continued to sit on the road. Many netizens called out the incident for being a "100 per cent insurance scam" and made sarcastic comments about the man's acting.

Anti-scam app ScamShield now available for Android users

(From left) Open Government Products director Li Hongyi, Minister Sun Xueling, Senior Minister Teo Chee Hean, NCPC chairman Gerald Singham and Deputy Commissioner of Police (Policy) Jerry See launching the Android version of ScamShield. ST PHOTO: GIN TAY

Android users can now download an app called ScamShield, which can block calls from blacklisted numbers that have been verified as scam-related.

The app, which can also identify scam SMSes, is available on Google Play Store.

It has been available to iOS users since November 2020.

WhatsApp users in S'pore urged to update app to patch security holes

The first system flaw allows an attacker to take control of the app while a user is making a video call REUTERS

WhatsApp users in Singapore have been urged to download the latest version of the application to fix two security flaws that could give hackers complete control over the app.

Issuing the alert on Wednesday, the Singapore Computer Emergency Response Team (SingCert) said users should install the latest version of the app "immediately" even though there are currently no reports of active exploitation of the loopholes.

The first system flaw allows an attacker to take control of the app while a user is making a video call.

How You can Avoid being Scammed

Scams have been increasing of late. Here’s how to stay safe

Ever received emails from “royals” seeking help to transfer money out of their country in exchange for a percentage of the loot? Or phone calls informing that you’ve won a seven-figure overseas lottery and the only way to receive the payout is by providing your banking details? These are just some examples of classic scams that have been around since mobile technology became a part of our everyday life.

Scammers, though, have been evolving in recent years, becoming sophisticated cons who not only target individuals but businesses and organisations as well. The first half of 2020 saw the number of scams in Singapore jump by 140 per cent compared to 2019. More troublingly, a survey by the Home Team Behavioural Sciences Centre found that 45 per cent of scam victims reported being scammed more than once. According to the Singapore Police Force, last year saw a whopping $201 million lost to scammers, much of it online as Singaporeans turned to websites and apps to carry out activities like banking and buying groceries due to the COVID-19 pandemic. Scammers have also begun to target people working from home through robocalls, as well as seniors who are unfamiliar with the Internet.

The rising number of scam victims is testament to the increasing psychological sophistication of scammers’ tactics in crafting false proof, impersonating the victim’s close friends and using the victim’s shame about possibly falling for a scam to continue extracting money from them. Romance scammers are especially adept at identifying victims who are lonely, vulnerable and easily manipulated — a group that is increasing in size worldwide, due to COVID-19’s impact on social lives. Ensure your safety and that of others by familiarising yourself with common methods of fraud. Here are the top 10 scams in Singapore (in no particular order):

- E-COMMERCE

- SOCIAL MEDIA IMPERSONATION

- INTERNET LOVE

- CREDIT-FOR-SEX

- CHINESE OFFICIALS IMPERSONATION

- TECH SUPPORT

- BANKING-RELATED PHISHING

- NON-BANKING-RELATED PHISHING

- LOANS

- INVESTMENT

4 common types of scams and how to recognise them

Scams are on the rise. Nearly 470 OCBC Bank customers lost at least $8.5 million to a spate of SMS phishing scams last month, and other banks such as DBS and UOB recently warned of similar scams impersonating bank employees.

Here are some of the most common types of scams going around:

- SMS phishing scams - In the recent scams involving OCBC Bank, fraudsters sent SMS messages claiming to be from the bank to trick its customers.

- Impersonation scams - Another type of phishing scam involves crooks posing as authority figures such as the police, job recruiters or government officials.

- E-commerce and delivery scams - Scams involving fake item listings often take place on e-commerce marketplaces, auction sites or trading features on social media platforms.

- Love scams - Posing as attractive potential partners, scammers usually target vulnerable victims on dating and social media platforms, often using stolen photos on their profiles.

财叔投资到身上长满蜘蛛网了😥 Did Uncle Cai invest in spider webs? Why are they all over him?

#金刚媒体 #kingkongmediaproduction MoneySense

$168m lost to top 10 scam types in first half of 2021; overall crime up by 11.2%

A total of 19,444 cases of crime were reported between January and June this year. PHOTO: ST FILE

Scam victims lost $168 million to conmen in the top 10 scam categories in the first six months of this year, a sharp spike from $63.5 million in the same period last year.

This comes on the back of a 16 per cent rise in the number of reported scam cases and a 11.2 per cent hike in overall crime, according to mid-year statistics released by the police on Monday (Aug 30).

A total of 19,444 cases were reported between January and June this year, up from 17,492 in the same period last year.

related:

Woman nearly loses S$500,000 in High Court impersonation scam; at least 50 such cases in first 9 months of 2021: Police

Between January and September 2021, there were at least 50 victims who were deceived by people impersonating High Court officials, with at least S$6.8 million lost, the police said

A 59-year-old woman nearly lost S$500,000 after she was tricked into providing her personal particulars and internet banking credentials by someone who claimed to be from the High Court.

The scam was foiled six days later on Oct 28, when the police and digital asset trading company QCP Capital intervened in time to convince the victim that she had fallen prey to a government official impersonation scam. In a news release on Friday (Dec 17), the police said that between January and September this year, there were at least 50 victims who were deceived by people impersonating High Court officials, with at least S$6.8 million lost.

In the case of the 59-year-old victim, investigations revealed that she received a call on Oct 22 from a man who claimed to be from the High Court purportedly informing her that she had been implicated in a money laundering case by an accused person.

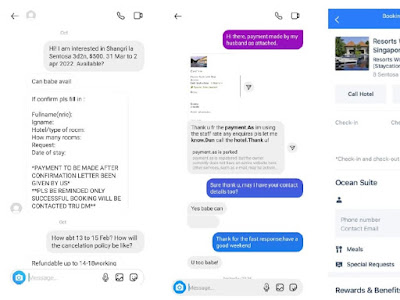

Some S$430,000 lost to scams involving hotel room bookings, 2 people arrested in separate cases

Screenshots of messages exchanged between a seller and buyer for hotel room bookings that are now under police investigations

In a news release on Thursday (Dec 16), the police said that a 45-year-old man and a 32-year-old woman have been arrested in separate cases. In the first case, the police received multiple reports in December from victims who allegedly failed to get their hotel rooms despite making payment to an unknown seller.

The victims came across the man’s advertisement for the room bookings on e-marketplace Carousell and proceeded to reach out to him via WhatsApp. They made payments through bank transfers and the PayNow digital application but did not get what they bought.

Over S$3.9m lost in 4 months: Police warn of scammers impersonating S’pore High Court, Interpol officials

More than S$3.9 million has been lost this year by victims of a new scam where swindlers pose as officials from the Singapore High Court or Interpol asking for payments to settle concocted offences, the police said on Wednesday (April 21).

The scammers told the victims that they were being investigated for money laundering activities and referred the victims to an Interpol officer called “Eric Wong Teng Hui”, the police said. Through messaging applications WhatsApp or Line, the scammers would then send the victims a photo of a fake Interpol international police pass.

They also sent victims a fabricated letter from the Singapore Police Force, signed off by an Inspector Yong Tian Ming, which would have the victims’ names and addresses printed on it. The scammers would then ask the victims to provide identification documents and surrender money via bank transfer pending investigations. The victims were told that the money would be returned afterwards.

related:

Another family loses life savings, this time to DBS’ S’pore Bicentennial Commemorative S$20 note phishing scam

Her mother was scammed by an SMS posing as DBS bank, wherein the receiver was "eligible to receive the Singapore Bicentennial Commemorative Note of S$20 for free."

A concerned individual appealed for assistance online after her mum fell victim to a “DBS Bicentennial Commemorative Note” phishing scam, resulting in her life savings “gone within seconds.”

Complaint Singapore Facebook page member Nayer Soh asked for advice from others on Sunday (Jan 23) as they were allegedly left in the dark regarding another phishing scam incident. She noted that her mother was scammed by an SMS posing as DBS bank, wherein the receiver was “eligible to receive the Singapore Bicentennial Commemorative Note of S$20 for free.”

The SMS included a URL, where, once clicked, enables scammers to retrieve the victim’s banking information and passwords. “Her entire life savings is gone within seconds, we called the bank and made police report immediately, but till today DBS has given no update (sic),” wrote Ms Soh.

Flier supposedly giving out FairPrice vouchers not created or endorsed by supermarket

The flyer has a QR code that leads to an online financial survey. PHOTO: NTUC FAIRPRICE/FACEBOOK

A flier being distributed that purports to give away free FairPrice vouchers is not from the supermarket chain, said FairPrice. The Chinese New Year flier instructs people to scan a QR code to an online financial survey to receive $20 worth of FairPrice vouchers. It is not clear if actual FairPrice vouchers are being given out.

In a Facebook post on Monday (Jan 24), FairPrice said the fliers are of unknown origin. It is not currently running any promotion that requires users to complete a survey to obtain gift vouchers, it added. "We would like to clarify that this flier and its attached promotion is neither created nor endorsed by FairPrice," said the supermarket. There have been a slew of high-profile scams recently, and organisations are on high alert. Nearly 470 OCBC customers lost at least $8.5 million in total last December in an SMS phishing scam. Some lost life savings built up over the years for their families.

FairPrice has also been targeted by scams. In 2018, it had to clarify that a message telling people that it was giving out gift cards worth $400 for its 45th anniversary was a scam. In 2016, a phishing scam claimed to offer people who filled in an online survey $500 in FairPrice vouchers.

LET'S FIGHT SCAMS!

In recent years, scam cases have continued to rise as scammers find various ways to dupe unsuspecting victims out of their hard-earned money. In the latest Police News Release on ScamSituation between January and March 2020, at least S$41.3 million was lost to scammers. This is about S$9 million (or 27.9%) more compared to the same period last year. In this issue of Police Life, read on to find out the scam situation and why it is important that everyone stays informed and vigilant against scams. Despite incessant efforts to push out anti-scam advisories, some continue to fall into these traps. To arrest this situation, tougher enforcement measures were rolled out in 2019.

TOP THREE SCAMS:

- E-Commerce Scams - The most common platforms for e-commerce scams in Singapore are digital platforms such as Carousell, Facebook, Instagram, Shopee and Lazada, where scammers typically tout low prices for their merchandise, which in turn attract unwitting online customers. To avoid being a victim of e-commerce scams, buy only from reputable platforms with customer protection policies or insist on paying only after the goods have been received or services have been rendered. Remember, if a deal is too good to be true, it probably is.

- Social Media Impersonation Scams - Scammers would usually ask the victims for their personal details such as their mobile number, Internet banking account details and One-Time Password (OTP) on the pretext of helping them to sign up for fake contests or promotions allegedly organised by Lazada, Shopee and Qoo10. Victims would later discover that fraudulent transactions had been made from their bank accounts and mobile wallets without their consent. Never share your Internet banking account details and OTPs with anybody – legitimate contests or promotions will never ask for such details. Your OTP is like your ATM pin, do not reveal it to anyone.

- Loan Scams - Members of the public would receive SMSes or WhatsApp messages offering loans and loan services. The scammers may claim to be staff from a licensed moneylender. Interested parties are instructed to transfer money as a deposit before the loan can be disbursed. After making the transfer, victims find that the scammers are no longer contactable. In another variant of loan scams, spoofed loan advertisement messages are purportedly sent by banks such as POSB, DBS, UOB, CIMB and OCBC. Banks and licensed moneylenders are not allowed to send out such loan advertisements.

Police Anti-Scam Centre works with banks to thwart scammers

Deputy Assistant Commissioner Aileen Yap (third from left), assistant director of the Specialised Commercial Crime Division in the Commercial Affairs Department, with the team of six officers across various departments in the police who helped set up the Anti-Scam Centre. They are (from left) Assistant Superintendent (ASP) Koay Lean Seong, Deputy Superintendent (DSP) Lim Hao Jun, ASP Sim Yi Cheng, Ms Sharon Xie, head of the Asset Confiscation Branch at the Commercial Affairs Department, DSP Eric Wong and ASP Lim Min Siang. ST PHOTO: JASON QUAH

Suspicious bank accounts linked to scams can now be frozen in a few days, thanks to collaboration between the Singapore Police Force and three major banks here.

By impeding fund transfers in this manner, the police's two-month-old Anti-Scam Centre aims to disrupt the operations of scammers and minimise the losses of victims.

Since it was set up on June 18, about 1,000 police reports relating to e-commerce scams and loan scams have been referred to the centre. So far, 815 bank accounts linked to scams have been frozen, allowing the recovery of 35 per cent - or about $850,000 - of the $2.4 million in losses in total.

NEVER RESPOND TO UNSOLICITED MESSAGES WITHOUT CHECKING

i was introduced to this friend by my mother's friend for a job – the number (+60

1112198241) whereby one can earn commission by helping the seller to purchase order using a system that is auto generated and will match it according to the money that is deposited. To summarize – we are being issued orders within one click and will be intelligently matched orders and be earning non-stop commission.

So firstly, had deposited SGD $300 into the account and we were instructed to paynow 98527515 and send a screenshot to the “Customer service” +65 85738125 and we will then receive an instruction to go into the app “Club Factory” and go to top up and then put in the amount that we had paynow to the person and include the screenshot in the app. So everything seemed fine when I had received 2 orders amounting to $899 which is insufficient as I had only topped up $300. Hence, I was told that the consecutive orders which are the 2 orders have to be completed in order to proceed and I had to top up $900 to complete the order and the money will be back into the system account and I can continue to proceed. To my surprise , I got a double order again and this time it amounts to $1099 and I had to top up another $1100 and I had to transfer to UOB 37039291?? REN ZENGSHA?? as I have to message the “Customer service” to get the account to transfer to always before sending the money.

After the money was in the account, I continued and to my horror, 3 orders in a row came in together and amounting up to $1997 and this time round I had to top up $2000 and I was assured that having multiple orders is normal and the max is 3 orders. The orders started to get more and more expensive, and the person kept rushing me to find money to complete orders as there is a time limit to it. After which I requested for a refund/ withdraw and I want my money back total $2300 and the “Customer service” said it was unable to proceed with my request and couldn’t get back my money. After repeated request to withdraw, she said that she need to communicate with the seller and need to apply for me and keep making excuses till the point that I mentioned that I will be going to the police, she threatened me that if the company have any losses / damages I have to take responsibility as they will hire lawyers to sue me and the platform will fully cooperate with the police investigations as all transactions are being recorded down and there is an SOP that they are following.

New measures announced to boost digital banking security amid spate of SMS phishing scams

“MAS expects all financial institutions to have in place robust measures to prevent and detect scams as well as effective incident handling and customer service in the event of a scam.” The measures include the removal of clickable links in SMSes or emails sent to customers, setting a default threshold of S$100 or lower for funds transfer transaction notifications and having a delay of at least 12 hours before the activation of a new soft token on a mobile device. Banks will also send a notification to the existing mobile number or email registered with the bank whenever there is a request to change these details.

Additional safeguards such as a cooling-off period before implementation of key account changes – such as key contact details – and more frequent scam education alerts will also be put in place. Dedicated and well-resourced customer assistance teams to deal with feedback on potential fraud cases on a priority basis are also required.

related:

ScamShield: Block unsolicited messages and calls

Block scam calls - ScamShield compares an incoming call against a list maintained by the Singapore Police Force to determine if the number has been used for illegal purposes and blocks it.

Filter scam SMSes - When you receive an SMS from an unknown contact, ScamShield will determine if the SMS is a scam using an on-device algorithm, and filter the messages to a junk SMS folder. Scam SMSes will be sent to NCPC and SPF for collation. This keeps the app updated and will help protect others from such scam calls and messages.

Report scam messages - You can also report scam messages from other chat apps such as WhatsApp, Wechat, IMO, Viber, etc. You can forward the messages via ScamShield’s in-app reporting function.

Avoiding and Reporting Scams

Common Scams:

- Social Security Scams - Scammers pretend to be from Social Security Administration and try to get your social security number or money.

- Phone Scams - These tips can help you hang up on a phone scammer and hold onto your money.

- Phishing Scams - Scammers use email or text messages to trick you into giving them your personal information.

- Unemployment Benefits Scams - Imposters are filing claims for unemployment benefits.

Old-school ‘Nigerian Prince’ scam, how S’poreans lost their money and the progression of scams

Scams have existed since ancient times, with the first recorded attempt in 300 BC. In the 1990s, it was the Nigerian Prince scam that bamboozled many of their hard-earned money

The scam was first mentioned in Singapore in 1991, with The New Paper highlighting swindlers “flooding Singapore with letters promising to pay” millions of dollars. Despite the logical approach of targeting the older generations who are less tech-savvy, the scammers actually went after businesspeople and companies. The letters were disguised as an investment opportunity with a commission that could yield millions. On Aug 2, 2021, a woman was sentenced to seven years and four weeks’ jail for helping Nigerian scammers move more than S$2 million out of Singapore, using over 20 bank accounts to secure their criminal proceeds.

The Singapore Police Force announced that S$201 million was lost to scammers in 2020, a jump of 140 per cent compared to 2019 as more Singaporeans turned to online transactions amid the Covid-19 pandemic. According to The Straits Times, scam victims lost S$168 million to fraudsters operating under the top 10 scam categories during the first six months of 2021. “The rising number of scam victims is testament to the increasing psychological sophistication of scammers’ tactics in crafting false proof, impersonating the victim’s close friends and using the victim’s shame about possibly falling for a scam to continue extracting money from them,” noted hometeamns.sg.

Here are the top 10 scams in Singapore, in no particular order:

- E-commerce

- Social media impersonation

- Internet love

- Credit-for-sex

- Chinese officials impersonation

- Tech-support

- Bank-related phishing

- Non-Bank-related phishing

- Loans

- investment

5 of the most remarkable instances in the history of fraud

The fight against fraud is an on-going battle, but it is not one faced exclusively by our generation. For as long as currency has existed, so has fraud.

Here we list 5 of the most remarkable instances in the history of fraud:

- 300 B.C – The earliest recorded attempt

- 193 A.D – The year of the five emperors

- 1821 – The imaginary prince

- 1911 – Louvre at first sight

- 1920 – Ponzi

International calls to have plus sign prefix to combat scam calls: Janil Puthucheary

All incoming international calls will be prefixed with a plus sign (+) beginning April as part of efforts to protect members of the public from scam calls, said Senior Minister of State for Communications and Information Janil Puthucheary in Parliament on Tuesday (March 3).

From April 15, the Infocomm Media Development Authority (IMDA) will require all telecommunication companies (telcos) in Singapore to introduce this measure to help combat such spoof calls from overseas.

Domestic calls will not display such a prefix.

How to spot an investment scam

Find out how you can spot an investment scam and what you can do to avoid falling prey to one. Key takeaways:

- All investments carry risks. Be wary of opportunities that offer high returns at little or no risk.

- Don't take everything at face value, or rush into committing your money.

- Always ask, check and confirm before you invest.

Scammers use increasingly sophisticated and effective tactics to get you to part with your money. Even though some investment scams may look like a real deal, there are some red flags you can spot to help you steer clear of them. All investments carry risk. The greater the promised investment returns, the higher the risk. Be wary when you encounter an investment opportunity that claims to guarantee or protect your capital while promising high returns. Many investment scams offer such lucrative promises in order to lure investors in.

It is important to check how the investment scheme can generate such high profits with low or no risk. Benchmark the returns - find out what other investments offer the same returns and see what the risks are like. It is unlikely that the investment you are being offered can provide the same returns without the same risks at least. Pressure tactics:

- "Limited time only! Invest before it sells out!"

- "Special rates for first 50 investors. Don't miss out on this golden opportunity!"

- "More than 2,000 people have invested - what are you waiting for?"

- "Invest today and get extra 10% credit with many other benefits."

Phishing and other SMS scams - Shouldn’t banks bear the cost?

Instead, the SMSes carried links to a fraudulent website requesting for banking information and passwords to resolve these “issues”. Unsuspecting customers would be asked to key in sensitive bank account login information like their username, PIN and One-Time Password (OTP).

Using this information, the scammers could then transfer monies out of the affected customers’ accounts and carry out other transactions. The scammers would reroute received monies through various, often overseas accounts, making it difficult to track their movement and even harder to recover the cash.

What Is Pig-Butchering Scam And how to Prevent it?

“Pig-Butchering Scam” is a fraud method that induces users to participate in various types of fraudulent investments such as financial investments, gambling games, foreign exchange and other types of fake investments through online dating. Scammers call the deceived users “pigs”.

Next, scammers will follow some established scripts and define themselves as rich and handsome / beautiful, then they will induce users to fall in love and try to gain trust. We call it “pig raising” during this stage. When it reaches a certain level of emotional foundation, scammers will start to lure the other party to invest, and the final stage of fraud is “kill the pig”.

Suggestions of The Prevention of “kill the pig” Fraud:

- “Don't believe it”, you need to be cautious when making friends online. Don't trust netizens, and don't believe in investment lies such as “stable profit without loss”, “low cost and high return” and so on.

- "Don't be greedy”, refuse the temptation of gambling and high-return investment, remember that only greed will be deceived because there is no such thing as a free lunch.

- “Don't transfer”, don't transfer money to unfamiliar accounts. When transferring money to acquaintances, you must also be cautious, and communicate more with your relatives and friends and ask more to prevent falling into a “trap”.

related: