Update 8 Oct 2021: After 17 years as CEO of Temasek Holdings, Ms Ho Ching finally stepped down on 1 Oct 2021

We look back at her journey from being "Student of the Year" at National Junior College to marrying Singapore's Prime Minister.

Retiring Temasek CEO Ho Ching to join Temasek Trust board, take over as chairman from April 1, 2022

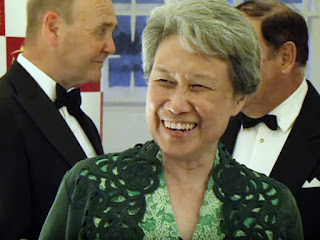

Ms Ho Ching will be appointed to Temasek Trust’s board of directors with effect from Oct 1, 2021, and take over as chairman from April 1, 2022. ST PHOTO: KUA CHEE SIONG

Ms Ho, 68, will be appointed to Temasek Trust's board of directors with effect from Friday (Oct 1), the same day she is retiring from the Singapore investment company.

From April 1, she succeeds Mr S. Dhanabalan, who will remain on the board and be designated chairman emeritus.

Ho Ching to join Temasek Trust board, take over as chairman in April 2022

Ms Ho Ching. (File photo: AFP/Roslan Rahman)

Temasek Trust announced on Thursday (Sep 30) that it has appointed Ms Ho Ching to its Board of Directors.

Ms Ho's appointment will take effect from Oct 1, the same day she retires as Temasek Holdings' chief executive officer.

Ms Ho will also succeed Mr S Dhanabalan as Chairman of Temasek Trust with effect from Apr 1 next year. Mr Dhanabalan, who has been chairman of Temasek Trust since September 2015, will remain on the Board and be designated chairman emeritus.

Switching chairs? Ho Ching set to become Temasek Trust chairman after stepping down as Temasek CEO

Prime Minister Lee Hsien Loong’s wife Ho Ching, who enjoyed her last day as chief executive of Singapore sovereign wealth fund Temasek just yesterday (30 Sept), begins a new role as a part of Temasek Trust’ board of directors today (1 Oct).

In six months’ time, she will replace former ruling party minister S Dhanabalan as chairman of the board. Mr Dhanabalan, who will be designated chairman emeritus when Mdm Ho takes over his role next April, announced yesterday:

“Ho Ching has a deep and passionate commitment to so many community causes, and has been instrumental in Temasek’s own stewardship journey over the past two decades. The Board decided we would ask her to join us, and to continue that commitment by leading Temasek Trust next year.”

Mdm Ho’s new role comes almost two decades since she joined Temasek. The Prime Minister’s wife joined the organisation as a director in January 2002 before she was promoted to executive director just four months later, in May. Two years after she joined Temasek, Mdm Ho became its Chief Executive Officer on 1 January 2004. After more than 17 years at the helm of Temasek, Mdm Ho handed over the reins of the sovereign wealth fund to Dilhan Pillay Sandrasegara today. The handover comes more than a decade after leadership succession plans for a new CEO fell through in a boardroom bust-up in 2009 – just three months before the new chief executive was supposed to take over.

Leadership Transition at Temasek Holdings: Dilhan Pillay Sandrasegara to be appointed Executive Director & CEO with effect from 1 October 2021

The Board of Temasek Holdings has announced that Mr Dilhan Pillay Sandrasegara will succeed Ms Ho Ching as Executive Director and Chief Executive Officer of Temasek Holdings with effect from 1 October 2021. He will concurrently hold his current appointment as Chief Executive Officer of Temasek International (TI).

Ho Ching will retire from Temasek Holdings and step down from its Board on the same date.

Announcing the change today, Mr Lim Boon Heng, Chairman of Temasek Holdings, noted: “Leadership succession is a strategic responsibility of the Board. We have had in place an annual review since the early 2000s. This is to enable the Board to be prepared for all eventualities, with various succession options over different time horizons.

Temasek abandons plan to install Chip Goodyear as chief executive

Former BHP Billiton boss quits job with Singapore's state investment fund three months before he was to take over. Plans to appoint Chip Goodyear, the former BHP Billiton mining boss, as chief executive of Singaporean investment company Temasek have been scrapped.

Goodyear has resigned after a boardroom bust-up, just three months before he was due to take over from Ho Ching, wife of the Singaporean prime minister.

In a joint statement, Temasek and Goodyear said that they accepted that "there are differences regarding certain strategic issues that could not be resolved. In light of the differences, both parties have decided that it is in their mutual interest to terminate the leadership transition process."

Ho Ching to retire as Temasek CEO on Oct 1

Temasek Holdings chief executive officer Ho Ching (left) will be succeeded by Temasek International CEO Dilhan Pillay.PHOTOS: REUTERS, TEMASEK

Temasek Holdings announced on Tuesday (Feb 9) that its chief executive officer Ho Ching will retire from the state investment firm and step down from its board on Oct 1.

She will be succeeded by Mr Dilhan Pillay, CEO of Temasek International (TI), the commercial arm of Temasek driving its investments.

Announcing the change, Temasek chairman Lim Boon Heng said: "Leadership succession is a strategic responsibility of the board. We have had in place an annual review since the early 2000s. This is to enable the board to be prepared for all eventualities, with various succession options over different time horizons.

Ho Ching to retire as Temasek Holdings CEO, Dilhan Pillay Sandrasegara to take over

Ms Ho Ching (left) is stepping down as Temasek Holdings' Executive Director and Chief Executive Officer with effect from Oct 1, 2021 and will be succeeded by Mr Dilhan Pillay Sandrasegara (right). (Photos: Temasek Holdings)

Ms Ho Ching will retire as the chief executive officer (CEO) of Temasek Holdings and step down from its board on Oct 1, the state investor said on Tuesday (Feb 9).

Taking her place is Mr Dilhan Pillay Sandrasegara, who will succeed her as CEO and executive director on the same day.

"Leadership succession is a strategic responsibility of the board," said Temasek Holdings chairman Lim Boon Heng. "We have had in place an annual review since the early 2000s. This is to enable the board to be prepared for all eventualities, with various succession options over different time horizons."

Fortune Names Ho Ching 20th Most Powerful Woman Outside Of US – Only S’porean To Make The Cut

© Provided by Vulcan Post Fortune Names Ho Ching 20th Most Powerful Woman Outside Of US - Only S'porean To Make The Cut

Fortune has released the 2020 edition of its Most Powerful Women Outside the United States, where a total of 50 women were shortlisted.

The top three on the list are: Emma Walmsley from the United Kingdom, who is also the CEO of GlaxoSmithKline, Jessica Tan, CEO of China’s Ping An Group, and Ana Botín, Executive Chairman of Spain’s Banco Santander.

According to Fortune, it “scans the globe” every year, to highlight the most powerful women in business based outside the United States. The list was created 20 years ago, and takes into consideration the size and health of a woman’s business, the arc of her career, as well as her societal and cultural influence.

#23 Ho Ching

Executive Director and CEO, Temasek

Ho Ching has been at Singaporean sovereign wealth fund Temasek for 17 years and has helped its portfolio grow to over $313 billion.

Temasek was one of the main investors in a $14 billion dollar fundraising round by Ant Financial, an affiliate of Alibaba.

Ho opened offices in San Francisco in 2018 and poured over a quarter of Temasek's money into sectors like life sciences, tech and agribusiness.

Ho is also the wife of Singaporean Prime Minister Lee Hsien Loong.

Temasek defends employees from India against 'divisive, racist campaign' on social media

Temasek, the investment company owned by the government of Singapore, has issued a response to what it called a "divisive, racist campaign" which also involved "false claims". Temasek said that some of its employees from India had been "targeted" on social media, in a statement posted on its website on Aug. 14.

Temasek said that it had referred the offending posts to Facebook, citing "clear breach of their own community guidelines on hate speech". It said that it would "continue to press them to be more active in stamping out such hate speech, wherever it occurs on their platforms."

It did not mention the allegations made in the posts, although The Straits Times reported that Facebook posts circulating in recent days had called attention to the LinkedIn profiles of Temasek employees, questioning why top positions in the firm were not filled by locals.

read more

Temasek – Our People, Philosophy and Policy

Some of our colleagues from India have been targeted recently on social media by a divisive, racist campaign. This makes us very angry at the false claims perpetuated. The Singaporeans among us are also ashamed at such hateful behaviour on the Singapore social media.

We stand by our colleagues who have been dragged into this through no fault of their own.

We know that the social media can be a force for good or bad. We believe there is a role for constructive debate and fact-based opinions in our society, even on contentious or sensitive topics, and even on social media. That should be balanced with civility and respect for others. There is no place whatsoever for racism to feature in these debates. Insidious posts designed to stir hatred and intolerance have no place in our society, and we denounce them.

read more

Govt directs Pofma office to issue 4 correction directions for ‘false statements’ over Ho Ching’s Temasek salary

In a media statement on Sunday (April 19), the Pofma office said that the correction directions were issued to HardwareZone user “darksiedluv”, The Temasek Review's Facebook page, The Online Citizen's Facebook page and website, as well as opposition leader Lim Tean

Deputy Prime Minister Heng Swee Keat, acting in his capacity as Finance Minister, has instructed the Protection from Online Falsehoods and Manipulation Act (Pofma) Office to issue four correction directions over what the Office said was a false statement about the remuneration of Temasek Holdings' chief executive officer Ho Ching.

In a media statement on Sunday (April 19), the Pofma office said that the correction directions were issued to HardwareZone user “darksiedluv”, The Temasek Review's Facebook page, The Online Citizen's Facebook page and website, as well as opposition leader Lim Tean.

The Pofma office said that there were “false statements of fact contained in a number of social media posts on Facebook and HardwareZone Forum, as well as an article on The Online Citizen website”.

read more

Temasek Refutes Claim Ho Ching Makes S$100 Million a Year

Temasek Holdings Pte denied speculation that Chief Executive Officer Ho Ching makes S$100 million ($70 million) a year

“This claim is false,” the Singapore state investor said in a rare statement addressing the pay of the top executive, who’s also Prime Minister Lee Hsien Loong’s wife. “Furthermore, Ho Ching’s annual compensation is neither the highest within Temasek, nor is she amongst the top five highest-paid executives in Temasek.”

Temasek manages a portfolio that’s valued at S$313 billion as of March 2019. It’s the biggest stakeholder in half of the country’s 10 largest companies by market value, including flag-carrier Singapore Airlines Ltd. and DBS Group Holdings Ltd., Southeast Asia’s biggest lender.

The company issued a response following “chatter based on an Asian talk show commentary,” it said. It reviews compensation practices across the financial industry annually, according to the statement.

related: Singapore PM’s Wife Defends His Seven-Figure Pay on Facebook

read more

Remuneration packages given to top managements at GIC and Temasek not interfered by the Government – Lawrence Wong

On Wednesday (8 May), Second Finance Minister Lawrence Wong said in Parliament that the Government keeps an “arms-length relationship” with GIC and Temasek Holdings, and does not get involved in their operational decisions, such as remunerations

Mr Wong, who is also Minister for National Development and sits on the GIC’s board of directors, was responding to Workers’ Party Member of Parliament (MP) Png Eng Huat, who asked if there is a salary cap for key management of companies like sovereign wealth fund GIC and state-owned investors Temasek Holding. The Minister did not reveal the salaries of the top brass at the two firms, and added that instead the Government expects the Boards to hold accountable for their respective performances.

Mr Png had specifically requested for the range of total annual remuneration – which include salary, annual and performance bonuses – of the top three highest-paid executives at GIC and Temasek Holdings over the last five years. As such, Mr Wong noted that remuneration falls on performance and industry benchmarks, and supports a “prudent risk-taking culture”. In addition, a part of the remuneration at both companies are also tied to long-term performance. Further pushing for figures, Mr Png said, “These two entities are managing our reserves, and the Government is the sole shareholder. Usually shareholders would know the remuneration packages for the companies they own.”

Despite the push, Mr Wong still refused to divulge the figure and said that there’s a system that is presented to determine compensation. Based on the past performances of these two entities, it shows that the system works, he added. The system does not solely look at “one or two expense items” like remuneration. Instead, it comprises of a “thorough assessment” to decide long-term expected return, which will then be proposed to the President who will conduct an independent assessment with the help of advisors. “Ultimately, the Government evaluates the performance of the two entities based on their long-term returns, net of all expenses incurred,” said Mr Wong. He added that the returns can be looked at their annual report. Although Temasek Holdings does not reveal the salaries of its top management in its annual report, a part of its website shows the compensation structure, where it is benchmarked against relevant markets and includes incentives and clawbacks based on performance.

related:

Kenneth Jeyaretnam encourages S'poreans to keep guessing about Ho Ching’s salary

Netizens call for transparency over Ho Ching’s salary;dissatisfied by Temasek’s statement

read more

“Is Ho Ching considered a civil servant?” Lim Tean questions POFMA order for sharing article about the Temasek CEO’s salary

Mr Lim further questioned why a “supposedly ‘private-exempt' company” that holds “money belonging to the People Of Singapore” gets to be protected by the Government and is exempt from public disclosure of “its management to the stakeholders"

Lawyer and opposition leader Lim Tean questioned the Correction Direction he received on Sunday (Apr 19) from the POFMA office concerning an article from The Online Citizen (TOC) about the salary of Temasek Holdings CEO Ho Ching that Mr Lim had shared on April 15.

The order had been issued by the Minister of Finance, Heng Swee Keat, to HardwareZone user “darksiedluv”, The Temasek Review’s Facebook page, The Online Citizen’s Facebook page and website, as well as to Mr Lim. Singapore’s Protection from Online Falsehoods and Manipulation Act (POFMA) was passed last year to combat the spread of online falsehoods.

The article on TOC’s site that Mr Lim had shared claimed that Madam Ho was receiving a salary of “NT$ 2.1 billion”, “about 100 million SGD” or “S$99 million a year,” which the Government decried as false.

read more

“Ho Ching is watching all of us” – Temasek CEO skirts question on the company’s plans for leadership succession

Instead of giving a direct answer as to what Temasek's leadership succession plans are, when he was asked to give details on these plans and on Mdm Ho's role at the company, Mr Pillay would only say that Mdm Ho is "very much now involved in the stewardship aspects of Temasek…she still keeps a watchful eye over all of us to make sure we continue to do the right thing"

Temasek International CEO Dilhan Pillay appeared to skirt questions on Ho Ching’s role at Temasek and the organisation’s plans for leadership succession, at a recent press briefing.

Temasek International is the investment arm of Singapore sovereign wealth fund, Temasek, which is led by Singapore Prime Minister Lee Hsien Loong’s wife, Ho Ching. Instead of giving a direct answer as to what Temasek’s leadership succession plans are, when he was asked to give details on these plans and on Mdm Ho’s role at the company, Mr Pillay would only say that Mdm Ho is “very much now involved in the stewardship aspects of Temasek…she still keeps a watchful eye over all of us to make sure we continue to do the right thing.”

The South China Morning Post noted that Mr Pillay also quipped, “Right now, she’s watching all of us,” and that this remark was met with laughter.

read more

Ho Ching to step down as chairman of Temasek’s subsidiary

Mr Lee Theng Kiat (centre) will take over Ms Ho Ching (left) as chairman of Temasek International, an arm of Temasek Holdings, in April 2019. Mr Dilhan Pillay Sandrasegara (right) will be chief executive officer of Temasek International

Ms Ho Ching will step down as chairman of Temasek International, the wholly owned management and investment arm of parent company Temasek Holdings.

Ms Ho — who remains as chief executive officer of state investment firm Temasek Holdings — said that the move is to ensure that Temasek International is “ready for disruptive challenges and opportunities in the decade ahead”.

Current deputy chairman and CEO Lee Theng Kiat will take over as chairman of Temasek International.

read more

Dear Prime Minister, what do you think of your wife’s Facebook posts?

Prime Minister Lee Hsien Loong, you know better than anyone else that your wife Ho Ching is a most compulsive social media user. Her never-ending mishmash of social media shares and posts give Singaporeans – and even foreigners – plenty to chew over.

Take her recent post of a cryptic “Errr…” in response to news that Taiwan was donating face masks to Singapore. That was not the first time she caused a bit of a ruckus. PM Lee, did you go “Arghh” when you saw her “Errr…”? Or when she posted a cheeky photo of a monkey making a rude gesture. Was that targeted at anyone?

And how did you react when your wife posted a spirited defence of seven-figure pay of politicians, arguing that Singapore’s political salary system is unique as it does not include perks or pension? PM Lee, what ran through your mind when you saw that?

related: Shouldn’t there be OB markers for what a PM’s spouse post online?

read more

Simon Lim: Meritocracy in Singapore tainted badly with how ministers’ spouses and military officers with no experience, being appointed to head GLCs

“Although faith in Meritocracy is weakening, the ideology will remain a key principle for recognising individuals in Singapore. Though meritocracy is under siege, it has not failed. In the last few years, meritocracy has taken on a negative overtones due to its association with elitism and there has been an ongoing debate over social inequality and stratification in society. Even those who rail against meritocracy struggle to come up with a better system”– Education Minister Ong Ye Kung.

True Meritocracy is a very noble ideal and meritocracy comes from the word, Merit. Over the years and especially during the early years of our nation-building, true meritocracy had served us well when only the truly best people were selected to do the jobs according to his/her merits. And even as inequalities and stratification are also growing, something deeper and more sinister have also been brewing too and if we ignore or pretend that it is not the case, our ostrich mentality will definitely cost our people and our country a great deal.

So, what has gone wrong with meritocracy in Singapore and more specifically, what has gone wrong with meritocracy in the pap government until it has now been much weakened, much questioned, despise and come under siege by our own citizens?

read more

“Meritocracy became tainted when PAP Ministers’ spouses and SAF officers were appointed to lead GLCs”

Socio-political commentator Simon Lim has asserted that meritocracy in Singapore became tainted when the spouses of People’s Action Party (PAP) ministers and senior military officials were appointed to lead Government-linked companies (GLCs).

In a Facebook post published on Wednesday (31 July), Mr Lim pointed to a recent quote by Education Minister Ong Ye Kung who had said that meritocracy will continue to be a key principle in recognising individuals in Singapore, even though the people’s faith in the ideology is weakening. Mr Ong had said: “Although faith in Meritocracy is weakening, the ideology will remain a key principle for recognising individuals in Singapore. Though meritocracy is under siege, it has not failed.

“In the last few years, meritocracy has taken on a negative overtones due to its association with elitism and there has been an ongoing debate over social inequality and stratification in society. Even those who rail against meritocracy struggle to come up with a better system.”

read more

Simon Lim August 1 at 7:44 AM

read more

Simon Lim August 5 at 11:04 AM

The lack of transparency and very, very questionable meritocracy practised by the pap government. Why was Lawrence Wong so reluctant to disclose the salaries of the top 3 earners at our sovereign wealth funds of Temasek Holding and GIC when he spoke in response to WP MP's question in Parliament? Aren't our reserves managed by our sovereign wealth funds public funds? If the answer is Yes, then where is proper accountability and transparency to the citizens? Transparency, by any standards, has been dragged through the mud. Period.

Lastly, the manner in which the pap government practises meritocracy is very questionable and even unconvincing among observing and thinking Singaporeans. Very senior military officers were deployed to head government organisations and government linked companies despite their lack of relevant experiences. Thinking citizens must wonder if all that is wise or could there be other hidden agendas? Think!

If all that and more are not examples and proofs that the pap government has lost its way, kindly prove me wrong.

read more

Dawn of a new era in Singapore politics

Tan Cheng Bock secretary general of the newly formed Progress Singapore Party no longer believes in the ethos that drives the dominant PAP of today. PAP is no longer the party that it once was. Decay, political or otherwise, has set in and like a good doctor, Dr Tan thinks a surgical strike is what it takes to keep the ruling party in check.

There have been many lapses, including loss of transparency, independence and accountability in recent years. “We do not know how Ho Ching and the spouses of ministers have come about to hold key appointments. We need to know what is the criteria for appointment of key positions,” he said.

“The ruling party has gone astray. It has failed to take in different perspectives and this may lead to negative consequences in the long term,” stressed Dr Tan.

read more

Good governance eroding, says Tan Cheng Bock

Asked to elaborate on his criticisms of the Government, he cited three issues: Appointment of ministers' spouses to top roles; the changes to the Elected Presidency in 2016 to ensure minority representation, which led to the 2017 Presidential Election being reserved for Malay candidates; and the 2017 parliamentary debate on the fate of founding Prime Minister Lee Kuan Yew's house at 38 Oxley Road.

He said the appointment of Prime Minister Lee Hsien Loong's wife, Ms Ho Ching, as chief executive of Temasek had left many "wondering why", alluding to a lack of transparency. "As you all know, Temasek is part of our reserves. We want to know how that selection process was made," he added.

Soon after Ms Ho became executive director in 2002, then Temasek chairman S. Dhanabalan said she was appointed on merit and not family connections. He also said PM Lee, who was then Deputy Prime Minister and Finance Minister, agreed to the appointment after Mr Dhanabalan ensured Ms Ho would not report directly to the Finance Ministry.

read more

Tan Cheng Bock and the Lee Hsien Yang factor

In what is likely to be his last shot at active politics, former presidential candidate Tan Cheng Bock went for the jugular.

Aiming his gun at Prime Minister Lee Hsien Loong, the 79-year-old retired doctor known for his cautious, considerate and considered style of politics said at a press conference to launch his Progress Singapore Party (PSP) last Friday (26 July), “As you all know, Temasek is part of our reserves. We want to know how that selection process was made…There must be many of you who were wondering why, for example, the wife of our Prime Minister has been appointed to be the CEO of Temasek.”

It was that rare occasion when he tackled the man rather than the ball. In the process, the good old doctor drew a decisive political marker by kicking the ball into the court of PM Lee and his wife, Ho Ching, and putting the disquiet about her controversial appointment right back onto the political stage.

read more

PSP wants to be a ‘credible alternative’ to PAP, but no regime change expected in next election

When asked to elaborate on what he meant by the erosion of good governance in Singapore, he said that the Government has not been very transparent about how it appoints individuals, especially those related to political office holders, to important positions.

As an example, he cited the appointment of Ms Ho Ching — the wife of Prime Minister Lee Hsien Loong — as chief executive of the sovereign wealth fund Temasek Holdings.

“We are not questioning the credibility of these people who are there. But we are worried… because if your process is not transparent, there isn’t much accountability.”

read more

Erosion of good governance the reason he started new political party: Tan Cheng Bock

Alluding to a lack of transparency in the process, he said: "I think there must be many who are wondering why, for example, the wife of our prime minister has been appointed to be the CEO of Temasek. As you all know Temasek is part of our reserves. We want to know how that selection process was made."

Prime Minister Lee Hsien Loong's wife Ho Ching is the CEO of Temasek. Soon after Ms Ho became executive director in 2002, then Temasek chairman S. Dhanabalan said she was appointed on merit and not family connections.

He also said PM Lee, who was then Deputy Prime Minister and Finance Minister, agreed to the appointment after Mr Dhanabalan ensured Ms Ho would not report directly to the Finance Ministry.

read more

Will Cheng Bock’s appeal to the Merdeka generation work?

Instead, he gave broad brushstrokes on why he decided to form his own party. It had to do with the erosion of the governance system, particularly over issues of transparency and accountability.

Pressed on this, he spoke about the opaque process of appointing office-holders, mentioning Temasek Holdings’ Madam Ho Ching, wife of the Prime Minister, by name.

Later, he referred to the FamiLEE fight over the fate of the late Prime Minister Lee Kuan Yew’s Oxley Road House. Parliament, he said, shouldn’t be used as a platform to air family disputes, referring to the Parliamentary session in July 2017 held for PM Lee Hsien Loong to answer questions of abuse of power, accusations levelled by his two siblings.

read more

New Singapore opposition party backed by PM's brother launched

After a 31-year tenure as Singapore's first prime minister marked by allegations of reduced civil liberties and free speech, Lee in 2004 handed over power to his 67-year-old son Lee Hsien Loong, who wants to pass on the reins to a hand-picked successor.

"I wholeheartedly support the principles and values of the Progress Singapore Party. Today's PAP is no longer the PAP of my father. It has lost its way," Lee Hsien Yang wrote on July 28 in a Facebook post.

Tan ran for president in the 2011 elections and nearly defeated the PAP's candidate in a four-way contest. This time, Tan hopes to unite Singapore's traditionally fractured opposition parties and offer a unified political alternative in Singapore. Since his departure from PAP in 2006, Tan became one of its most vocal critics. He questioned the appointment of the prime minister's wife, Ho Ching, as the CEO of government-owned investment company, Temasek Holdings, as well as the use of parliament to debate the family feud over Lee Kuan Yew's residence.

read more

PSP wants to be a ‘credible alternative’ to PAP, but no regime change expected in next election: Tan Cheng Bock

When asked to elaborate on what he meant by the erosion of good governance in Singapore, he said that the Government has not been very transparent about how it appoints individuals, especially those related to political office holders, to important positions.

As an example, he cited the appointment of Ms Ho Ching — the wife of Prime Minister Lee Hsien Loong — as chief executive of the sovereign wealth fund Temasek Holdings.

“We are not questioning the credibility of these people who are there. But we are worried… because if your process is not transparent, there isn’t much accountability.”

read more

I have no view one way or other about who deserves what.

I have however, one view about tables of comparison like the one given in the article.

One big difference is the clean wage system in SG - ie no other perks in kind during office, and no pensions or other benefits after leaving office in SG.

In most, if not all, other countries, they would have many other perks during term of office, like butlers and hairdressers, free flights on national airlines, even family holidays, etc; and quite a number like the USA would include perks after end of term of office.

I do have one more view about pay for public service, whether for political office or “do good” areas like social services.

read more

Ho Ching, please stop dissembling and tell us how much you earn as a Gov employee

Thirdly and most importantly why is Ho Ching talking about her husband’s salary while she ignores the elephant in the room, which is what she is paid and which she refuses to disclose. If Piyush Gupta is paid $12 million p.a. while the head of SingTel earns over $20 million (including share options), then she must be paid several times that. We cannot just be stonewalled in Parliament by the fiction that Temasek is a private company. I have said many times over the years that it is extremely likely that she is paid more than $100 million a year and has earned more than a billion dollars while she has been at Temasek. Yet her remuneration is treated like a state secret and guarded as closely as the size of our reserves. And when she talks about a “clean” salary without any perks she and her husband need to explain why they are using the Gulfstream owned by Temasek’s subsidiary, ST Aerospace, and whether it is available for her to use for private trips as CEO. Neither does she reveal whether her family money is invested alongside Temasek’s making use of inside information and getting cut in early on special deals.

It is clear that Ho Ching occupies much the same role as Kwa Geok Choo did for LKY. While LKY was paid an obscene salary by the standards of other world leaders, the real money was being scooped up by his wife in her role as head of Lee & Lee. My father was able to establish that Lee & Lee were the preferred lawyer for the HDB’s conveyancing though at the expense of losing our family home. It was probably her that LKY was referring to when he said in 1994 that lawyers were able to make $4 million p.a. Like LHL’s mother, Ho Ching is able to make the real money while her husband is paid a meagre pittance of only $2.2 million p.a.

I wonder who is really richer: the Najib and Rosmah Show or our very own first couple. I guess we will never know.

read more

Lee Hsien Yang last Wednesday

Ho Ching to step down as chairman of Temasek’s subsidiary

Mr Lee Theng Kiat (centre) will take over Ms Ho Ching (left) as chairman of Temasek International, an arm of Temasek Holdings, in April 2019. Mr Dilhan Pillay Sandrasegara (right) will be chief executive officer of Temasek International

Ms Ho Ching will step down as chairman of Temasek International, the wholly owned management and investment arm of parent company Temasek Holdings.

Ms Ho — who remains as chief executive officer of state investment firm Temasek Holdings — said that the move is to ensure that Temasek International is “ready for disruptive challenges and opportunities in the decade ahead”.

Current deputy chairman and CEO Lee Theng Kiat will take over as chairman of Temasek International.

read more

Leadership Succession at Temasek International

Temasek is pleased to announce its leadership succession at Temasek International Pte Ltd, the wholly owned management and investment arm of its parent company Temasek Holdings Pte Ltd.

Dilhan PILLAY SANDRASEGARA, 55, will succeed LEE Theng Kiat, 65, as Chief Executive Officer of Temasek International, with effect from 1 April 2019.

Mr Lee will take over from Ms HO Ching as Chairman, Temasek International, on the same date.

read more

Is there a more indispensable and irreplaceable one than Ho Ching?

With Ho Ching stepping down as chairman of Temasek International from 1 April, there are those who speculate that the time might come for her to finally relinquish her all-powerful position as CEO of parent company Temasek Holdings, a role she has held for 15 years.

Such conjecture may be premature. It could yet be another red herring. A decade ago, Temasek kicked off its succession planning. With much fanfare, Charles “Chip” Goodyear was brought in to replace Ho Ching back in 2009, but he abruptly left after only several months as CEO-designate.

All we got was a terse statement from Temasek chairman S Dhanabalan: “It is with much regret that both Chip and the Board have accepted that it is best not to proceed with the leadership transition. We wish Chip all the best in his future endeavours and are happy that Ho Ching has agreed to continue as Executive Director and CEO.”

read more

The secret that is Ho Ching’s salary – will we ever know?

The annual remuneration of the Chief Executive Officer (CEO) of Temasek Holdings seems to be the most well-kept secret, with Singaporeans asking, questioning and even speculating what that elusive number could be.

With Ho Ching heading the fund for the past 16 years, since 2002, many push for some transparency.

One Singaporean, Philip Ang, did some calculations and comparisons on his blog.

read more

Ho Ching criticises Boeing over a “lack of balls”

She was referring to a news article that linked the crash of the Ethiopian Airlines to a lack of proper training for the pilots to fly the Boeing 737 MAX 8 aircraft. The Australian reported that the only requirement for pilots to fly the Boeing 737 MAX 8 was simply a 56-minute training video – not simulator trainings or flights with supervising captains.

Pointing out that the low-cost training proposition and the transitional ease for pilots – combined with the increased capacity, range and better fuel efficiency – made the craft sound “the perfect aircraft for cash-conscious airlines with expansion on their mind,” the publication published a quote by aviation consultant Neil Hansford who said:

read more

If we vote for PM Lee, we are also voting for Ho Ching as a package deal?

I understand that political spouses have a certain role to play alongside their husbands or wives who are politicians. They are on hand to formally greet dignitaries and provide social support. This role however is ceremonial at best. It has no official capacity. After the initial greetings and pleasantries which are photographed, these spouses usually retreat when actual discussions commence.

It therefore comes as a surprise that wife of Prime Minister Lee Hsien Loong (PM Lee), Ho Ching was reported to have joined PM Lee, Deputy Prime Minister Teo Chee Hean, China's Vice President Wang Qishan together with other Singapore ministers and officials, as the group sat down to discuss various issues.

While Ho Ching, as head of Temasek Holdings, is a powerful woman in her own right, it still remains that she has no official governmental role. In that regard, her presence at governmental discussions may be misplaced. Instead of sitting down to join the group in their discussions, shouldn't she have left after the initial greetings?

related: Ho Ching attends meeting with China’s VP Wang Qishan

read more

The head of Singapore’s sovereign wealth fund is a familiar face to many and interest in the fund’s chief executive has always been rife, considering that she is also Singapore Prime Minister Lee Hsien Loong’s wife.

This year, Ho Ching will complete 16 years at Temasek. She joined the organisation, then called Temasek Holdings, as a director in January 2002 before she was promoted to executive director just four months later, in May. Two years after she joined Temasek, Ho Ching became its Chief Executive Officer on 1 January 2004 – a role she has held for the past 14 years.

Interestingly, next year (2019) will not only mark a decade and a half since Ho Ching took the reins of Temasek, it will also mark a decade after leadership succession plans for a new CEO to replace Ho Ching fell through in a boardroom bust-up in 2009 – just three months before the new CEO was supposed to take over.

related:

Temasek uses scandal-ridden audit firm accused of fraud, corruption and improper practices by governments around the world

Temasek has not changed auditor for nearly a decade, despite managing a portfolio valued at $308 billion

WHY DOESN’T TEMASEK DISCLOSE MANAGEMENT COSTS

read more

Lee Hsien Loong has yet to identify a clear successor – but what about Ho Ching?

While the lack of an identifiable successor for next Premiership has concerned Singaporeans, another critical entity – Temasek Holdings – also seems to face a lack of a successor.

According to the Government, the national investment entity manages $198 billion of our reserves. The weight of this organization was also emphasized by former Finance Minister Tharman Shanmugaratnam, who said in Parliament that the government has a clear interest in Temasek continuing to have strong leadership, so that it can deliver good returns over the long term”.

Yet, there appears to be no successor for Ho Ching who has been Temasek’s CEO since 2002. While we have no details as to when the search for her successor started, some reference can be made to a Parliamentary response which stated that Temasek’s Board and the current CEO Ho Ching has “set about the process of CEO succession review since 2005”.

read more

Govt won't interfere in choice of Temasek CEO, says Indranee

Temasek Holdings chief executive Ho Ching has been in the position since 2004, and the future leadership is a subject of some public interest. FOTO: BLOOMBERG

The Government will not interfere when Temasek Holdings eventually decides on who its next chief executive will be, said Senior Minister of State for Finance & Law Indranee Rajah yesterday.

The issue arose in Parliament when Non-Constituency MP Leon Perera noted that Deputy Prime Minister Tharman Shanmugaratnam had mentioned in 2009 that suitable candidates were being looked at, & asked why there has not been any progress since in the search for the next CEO.

Temasek Holdings chief executive Ho Ching has been in the position since 2004, & the future leadership is a subject of some public interest.

read more

Parliament: Temasek holds annual review exercise on CEO succession

"For CEO succession, the Temasek board reviews & tracks a list of candidates annually. These include those from within the company as well as those from outside Temasek, both in Singapore & abroad," said Ms Rajah, who is also the MP for Tanjong Pagar GRC.

"This confidential list of candidates ranges from those who can step in immediately, to younger candidates who could be potential successors beyond the 5-year period."

Mr Perera noted that Deputy Prime Minister Tharman Shanmugaratnam had mentioned in 2009 that there were candidates under review, and asked why no further progress has been made since in the search for the investment firm's next chief.

read more

Temasek holds annual review exercise on CEO succession

Temasek Holdings' board conducts an annual review of potential candidates as part of succession planning. FOTO: BLOOMBERG

Temasek Holdings' board conducts an annual review of potential candidates as part of succession planning.

Senior Minister of State for Finance & Law Indranee Rajah said this at the Parliament on Friday (Mar 10), in response to a question by non-constituency member of parliament Leon Perera on Temasek's CEO succession plans.

Temasek Holdings' chief executive Ho Ching has been in the position since 2004. A board committee is in place to hold annual reviews & make recommendations to the board.

read more

Minister Indranee: Government have no interference in Temasek Holdings’ CEO appointment

Ho Ching is the Prime Minister’s wife and has been sitting as the CEO of Temasek Holdings managing CPF funds from the government

In a response to NCMP Leon Perera’s question why the Prime Minister’s wife Ho Ching is still Temasek Holdings’ CEO for more than 13 years, Senior Minister of State Indranee Rajah claimed that the government do not interfere in the CEO appointment for the sovereign wealth fund company.

NCMP Leon Perera asked in Parliament yesterday (Mar 10):

The mystery of Ho Ching

If you run down the list of 100 women, you can be sure that the women (with very few exceptions like Ho Ching) are subject to intense public and media scrutiny

Ho Ching is conspicuously different. When was the last time you saw her deliver a speech at an event? Give a media interview? Subject herself to account for anything?

She does not even front the annual press conference to present the Temasek Holdings’ financial scorecard. This is so unlike other major organisations like SingTel and DBS Bank – you can be sure the CEO is front and centre of of it all when their financial performance is presented, fielding questions and giving media interviews. Temasek Holdings appears to adopt the unusual stance of putting the CEO at the backburner when it comes to media relations, transparency and accountability.

Ho Ching has been CEO of Temasek Holdings since 2004. For many years now, we have been hearing the usual refrain from Temasek Holdings about succession planning. This year, at its annual press conference, the same thing was regurgitated, this time by investment head Dilhan Pillay Sandrasegara: “As we have said over the years, the board has an annual succession review and that’s the discipline we put in place.” We call this PR-speak – rehearsed words that say something but really mean nothing.

read more

Ho Ching on Forbes Lists

For half of 2015, Ho Ching, the CEO of Temasek Holdings, took a sabbatical from the Singapore state-owned investment firm before returning in the autumn. Ho, who has been on the Power Woman list every year since its inception in 2004, helped guide her firm to a $266 billion portfolio last year.

She has been with the company for 14 years, initially joining as the executive director, and was appointed to CEO in 2004. The firm has recently signaled its desire to look for opportunities in Europe. With a master's degree in electrical engineering from Stanford University in hand, Ho started her career as an engineer with the Ministry of Defence of Singapore in 1976.

She is married to Lee Hsien Loong, the nation's prime minister and son to the country's first PM, Lee Kuan Yew, who died in March 2015.

read more

Ho Ching - CEO & Executive Director of Temasek Holdings

Ms. Ching Ho has been the Chief Executive Officer of Temasek Holdings (Private) Limited since January 2004 and has been its Executive Director since joining in 2002. Ms. Ho served as the Chief Executive Officer and President of Singapore Technologies Pte. Ltd. from April 1987 to December 2001. She joined Singapore Technologies (ST) in 1987 as Director of Engineering.

She started her career as an Engineer with the Ministry of Defence of Singapore in 1976. She is Chairman of Temasek International. She has been the Chairman of the Board at Chartered Semiconductor Manufacturing Ltd. since August 1995. She served as the Chairman of GLOBALFOUNDRIES Singapore Pte. Ltd. since August 1995 and Singapore Technologies Engineering Ltd. She served as a Deputy Chairman of Singapore Technologies Pte. Ltd. Ms. Ho has been on the Board of Directors of Chartered Semiconductor Manufacturing Ltd. since November 1987. She served as a Director of SembCorp Industries Ltd. until June 1, 2002 and GLOBALFOUNDRIES Singapore Pte. Ltd. since November 1987. She served as a Director at Singapore Technologies Pte. Ltd. She served as the Director of Defense Material Organization and Deputy Director of Defense Science Organization. Ms. Ho is involved in community service and charitable organizations in her personal capacity. She was the Chairman of the Institute of Molecular Agrobiology. In her public service over the years, she served on various statutory boards and agencies, such as the Economic Development Board, the National Science and Technology Board, the Singapore Institute of Standards and Industrial Research and the Productivity and Standards Board.

For her public service, she was awarded the Singapore Public Administration medal (silver, 1985) and the Public Service Star (1996) award by the Singapore Government. Ms. Ho is a Distinguished Engineering Alumnus of the National University of Singapore and an Honorary Fellow of the Institute of Engineering, Singapore. Ms. Ho received a Bachelor of Engineering (Electrical, 1(st) class Honours) in 1976 from the University of Singapore and the Master of Science (Electrical Engineering) in 1982 from Stanford University.

read more

Ho Ching

Ho Ching is executive director & chief executive officer of Temasek Holdings. One of the top students in her cohort, she did her “A” levels at National Junior College where she was named Student of the Year. She went to the then Singapore University as a President’s Scholar, and graduated in 1976 with a Bachelor of Engineering (Electrical, 1st Class Honours). In 1982, she graduated from Stanford University with a Master of Science (Electrical Engineering).

Ho Ching started her career as an engineer with the Ministry of Defence in 1976. In 1983, she became Director, Defence Materiel Organisation, the defence procurement agency of the Ministry, and held the concurrent position of Deputy Director of Defence Science Organisation (DSO).

She joined the Singapore Technologies group in 1987 as Deputy Director of Engineering and took on various senior responsibilities, before becoming its President and CEO in 1997. She is credited with repositioning and growing the group in the five years that she led it. For instance, she was the architect for the formation and listing of Singapore Technologies Engineering as the largest listed defence engineering company in Asia in 1997, and served as its first Chairman.

read more

Ho Ching CEO, Temasek

CEO Ho Ching has revived her Temasek Holdings from one of its worst-performing years. This year, the Singapore state-owned investment firm built a record-breaking S$275 billion ($202 billion) portfolio due in part to Ho's global hunt for innovation.

She opened offices in San Francisco last February and poured more than a quarter of Temasek's money into sectors like technology, life sciences and agribusiness. Temasek reportedly was considering a $500 million investment into Magic Leap -- a wearable-technology startup that's intrigued the likes of Alibaba, Qualcomm and Google's parent company, Alphabet Inc.

A personal scandal over historic family artifacts threatened to overshadow her accomplishments in the local press.

read more

Making Sense of Ho Ching’s Facebook Page

Despite being named by Forbes as one of the most powerful women in the world (and certainly the most powerful woman in Singapore), we know absolutely nothing about Mdm. Ho Ching beyond the basic facts. No mainstream media outlet has ever profiled her and she is rarely mentioned in news reports except in PM Lee’s company. We do not know what her political opinions are, what her vision for Singapore’s future is, or even her favourite food.

After being CEO of Temasek for 14 years, PM Lee’s spouse and the person responsible for everyone’s monies remains a complete mystery. Except on social media, where she shares often and without inhibition.

So what better way to learn about Ho Ching than by reading everything on her Facebook page?

read more

HO Ching 10 April 2016

Peace, folks, and embarrassed apologies from this Twitter newbie.

Had been playing around with Twitter y'day, trying out different buttons, seeing what can or cannot be done.

Discovered Twitter reposts pictures without captions, and unfortunately one of the pictures could be misunderstood on its own.

read more

Temasek : Ho Ching to stay indefinitely

When they brought in Goodyear, we were told that Temasek has been looking for a successor for Ho Ching since 2005 [Link]. It took them 4 whole years to find Chip Goodyear who turned out to be unsuitable so Ho Ching will stay. Minister Tharman said yesterday that Temasek has "no deadline" to find a successor. That I say is one heck of an incredible story. Incredible that they took 4 years to find Goodyear, incredible that they conduct such a search without deadlines, incredible that Goodyear turned out to be 'unsuitable' and incredible that they expect Singaporeans to believe this amazing explanation.

I think the opposition in Singapore must be celebrating. Yes celebrating. Why? After losing $50B of taxpayer's money and making horribly numerous ill-timed investments ( selling BoA at the market bottom etc), they now expect us to believe they bungled the selection of Chip Goodyear for Temasek CEO. The arrival of Chip Goodyear and Ho Ching stepping down provided some kind satisfactory closure for many Singaporeans after the torrent of bad news. Whether they genuinely bungled by selecting Goodyear or there are other hidden reasons, it has caused great damage to the govt's credibility .

This is going an issue that opposition parties can exploit during the next election especially if Ho Ching continues to stay at Temasek.

read more

Temasek CEO Ho Ching to quit after rocky ride

Former BHP Billiton CEO Chip Goodyear (R) looks at Temasek Holdings Chief Executive Ho Ching as she speaks during a news conference in Singapore February 6, 2009. Singapore state investor Temasek Holdings said on Friday its chief executive Ho will step down and be replaced by Goodyear on Oct. 1. Ho, wife of Prime Minister Lee Hsien Loong, joined Temasek as a director in January 2002 and has been CEO since January 2004. REUTERS/Vivek Prakash

Ho Ching will step down as the chief executive of Singapore state investor Temasek Holdings, as it faces a difficult time after a turmoil in global markets slashed the value of its investments.

Chip Goodyear, the former CEO of BHP Billiton, will replace Ho, wife of Singapore Prime Minister Lee Hsien Loong, on October 1. The move will help Temasek to build a more global image from a fund viewed in some quarters as an agent of the Singapore government.

Temasek, which had assets worth S$185 billion ($123 billion) as of March 2008, is nursing losses from its high profile investments in Merrill Lynch and Barclays (BARC.L) as it aggressively expanded outside its core Asian market.

read more

Temasek succession plans under scrutiny as CEO Ho takes leave

An engineer by training, Ho Ching joined Temasek in 2002 as executive director and was appointed chief executive officer in 2004. Photo: Charles Pertwee/Bloomberg

Temasek Holdings Pte chief executive officer Ho Ching’s three-month sabbatical raises the question that’s been asked repeatedly in the past six years: who will steer Singapore’s investment mothership when she eventually leaves?

Ho, 62, said last week she’s taking time off to attend to “a couple of long-standing things” and catch up on sleep, while assuring the public she’s “well.” The leave follows two months during which her husband, Singapore prime minister Lee Hsien Loong, was operated on for prostate cancer, and his father, Lee Kuan Yew, the nation’s first premier, died at 91.

Temasek, Singapore’s state-owned investment company, is trying to avoid the 2009 debacle when it appointed BHP Billiton Ltd. head Charles “Chip” Goodyear as CEO designate to replace Ho, said Victoria Barbary, director at the London-based Institutional Investor’s Sovereign Wealth Center. Goodyear left within months over differing views on strategy.

“The Chip Goodyear situation is not going to happen again,” Barbary said. “A successor won’t be a Westerner parachuted in. The person might not be in Temasek now. But it will be a person from the wider world of Singapore Inc.”

read more

All In The Family

The Financial Times (FT) newspaper first reported on Wednesday 15 June that daughter-in-law Ho Ching, 58, might leave Temasek (the company, not the website) at a time when the investment firm has turned around from losses from the financial crisis, "during which the value of its portfolio fell from S$185 billion to S$130 billion". In response to rumours that she will likely step down in August (Temasek releases its annual review for the year ended March 31 in early July), Temasek spokesperson Jeffrey Fang told MediaCorp, "We decline to comment on the speculation."

Reuters now report that Ho Ching told her employees that had she had to leave on a high note, she could have done so last year. Last year Temasek's port folio rose 43% year-on-year to $186 billion at the end of March. The same last year, her husband had no inkling that the election results will net a significant dive at the polls.

This is not the first time there has been talk that Ms Ho Ching, wife of Prime Minister Lee Hsien Loong, might leave Temasek, and probably not the last. In 2009, it was officially announced that former BHP Billiton CEO Charles Goodyear would be her replacement. Chairman Dhanabalan, while trumpeting that "Ho's resignation had nothing to do with her performance", even cited a White Paper that supposedly tabulated the rationale for her stepping down. Nobody saw that piece of documentation. What we witnessed next was the sudden departure of Goodyear 4 months after his appointment on 1 March, with Temasek citing "unresolved strategic differences." The main stream media quoted stuff like Goodyear would not allow Blackberries to be used during meetings.

read more

Risk-taker Ho Ching has no regrets

Ho Ching, wife of Singapore Prime Minister Lee Hsien Loong, will step down as chief executive of Temasek, ending a 5-year term which saw the state investment agency expand aggressively beyond Singapore.

It was also involved in controversies around the region.

Ho, 55, joined Temasek as a director in January 2002 and became CEO two years later. She will be replaced by Chip Goodyear, former chief of global miner BHP Billiton, in October.

read more

Leaving On a High

The good times will go on, argues retiring (young) BHP Billiton Chief Chip Goodyear.

Chip Goodyear reckons 49 is a good age to retire, not that anyone believes the outgoing chief executive of BHP Billiton , the world's biggest mining company, will spend the rest of his time watching sunsets, sipping a piña colada on a tropical beach.

The reality is that Charles Waterhouse Goodyear IV, a descendant of the Goodyear lumber and railway family of New York and Pennsylvania (and an indirect descendant of the tire clan), is taking a break between careers.

read more

Temasek finds a replacement for Goodyear!

Temasek Holdings, Singapore’s sovereign wealth fund, has found a replacement for Charles “Chip” Waterhouse Goodyear IV – it’s in the revision of its charter!

What Goodyear, or whoever that guy was, could not do, Temasek’s revision of its seven-year old charter will do.

Temasek will get its money out of Singapore as soon as possible, and invest in countries like the United States – folks who really need the money.

read more

Leaked cables on the failed leadership transition of Temasek Holdings

6 years ago, the intended leadership transition of the Temasek's Chief Executive Officer between former BHP Billiton chief Charles 'Chip' Goodyear and Mdm Ho Ching came to an abrupt stop when the private investment company announced the departure of Goodyear due to differences between him and the board of directors regarding certain strategic issues that could not be resolved.

"Four months into the leadership transition, the Temasek Board and Mr Goodyear have concluded and accepted that there are differences regarding certain strategic issues that could not be resolved. In light of the differences, both parties decided that it is in their mutual interests to terminate the leadership transition process and hence the executive relationship with effect from 15 August 2009. Mr Goodyear will also step down from the Temasek Board effective the same date." - Temasek Holdings, 21 July 2009.

Temasek Chairman, Mr Dhanabalan earlier said, “Ho Ching has been instrumental in bringing Chip on board. We have been working on this appointment for more than a year.” This was when Goodyear was first announced to be taking over the role of CEO from Mdm Ho on 6 February 2009. He also said that Mr Goodyear shares the vision and values that underpin Temasek as a key Singapore institution and an international investment company. “Chip presents a rare and unusual combination of investment and operational experience that can support the continued transformation of Temasek,”

read more

Wikileaks: Former CEO left due to Ho Ching’s Micromanagement

Back In 2009, Temasek had appointed the CEO at at mining company BHP Billiton - Charles 'Chip' Goodyear – to take over Ho Ching. However, Goodyear had left after six months due to “certain strategic issues that could not be resolved”.

Needless to say, his departure had raised considerable questions from international observers and the media alike. Reuters had described Goodyear’s departure as a “shock exit”. According to another article by The Guardian, Ho Ching “had no plan to leave her post, and her stance was supported by the government”. This promoted Low Thia Khiang – one of two opposition MPs then - to ask the reasons behind Goodyear’s departure.

However, this had no effect as the then Finance Minister Tharman responded that it “would not be appropriate for the Government to add to the statement, bearing in mind that the Government had no role in the decision by the Board and Mr Goodyear not to continue with the CEO transition”.

read more

Temasek has much to explain over Goodyear

The about turn in Temasek’s appointment of Mr Charles Goodyear as CEO to replace Ms Ho Ching is a sad but accurate reflection of the abysmal leadership seen at the organisation.

Chairman of Temasek, Mr S Dhanabalan, had said in an announcement in February this year when Mr Goodyear was first appointed that the company had been “working on this appointment for more than a year.” He added that Mr Goodyear “shares the vision and values” of Temasek. Barely four months later, we learn that this appointment has been reversed because of “differences regarding certain strategic issues that could not be resolved.”

Given that Mr Goodyear’s appointment has been deliberated for over a year, is it plausible that strategic issues cropped up only at the last minute? What were these differences and why can’t they be resolved?

read more

Temasek abandons plan to install Chip Goodyear as chief executive

Plans to appoint Chip Goodyear, the former BHP Billiton mining boss, as chief executive of Singaporean investment company Temasek have been scrapped.

Goodyear has resigned after a boardroom bust-up, just three months before he was due to take over from Ho Ching, wife of the Singaporean prime minister. In a joint statement, Temasek and Goodyear said that they accepted that "there are differences regarding certain strategic issues that could not be resolved. In light of the differences, both parties have decided that it is in their mutual interest to terminate the leadership transition process."

Former BHP Billiton boss quits job with Singapore's state investment fund three months before he was to take over

read more

SINGAPORE SWF TEMASEK REVERSES LEADERSHIP TRANSITION

Temasek Holdings, one of Singapore's two sovereign wealth funds, announced it had canceled plans for U.S. citizen Charles Goodyear to take over as CEO on October 1. Ho

Ching, the current CEO and Executive Director (and PM Lee's wife) will remain in charge. The announcement abruptly ended a brief relationship that some analysts had hailed as a step toward greater transparency for the fund.

Temasek announced the decision as a mutual agreement based on "strategic issues," but some local analysts are skeptical and suspect planned personnel changes and Goodyear's critiquing of Temasek's investments were to blame.

Market observers criticized the move for its lack of transparency and called for greater disclosure of the reasons for it. Although the future of Temasek's leadership is in question, analysts do not expect this move to have a significant impact on its portfolio decisions. The company is expected to pursue growth opportunities by expanding its portfolio in China, India, and Brazil, and by rebalancing away from some financial sector investments and toward energy and natural resources.

read more

Why Ho Ching Won’t Respond to Me

I am frequently asked why Temasek or the Singaporean government refuses to respond to what I have written about the obvious discrepancies in their financial accounts. The answer is simple: they cannot respond. Let me explain some of the reasons:

read more

Temasek Found A Replacement For Goodyear!

According to Temasek, its revised charter is one that “more accurately reflects its investment objectives and relationship with the Singapore Government.”

Sure it does, and let’s see how. Temasek will morph into an investment company managed on “commercial principles,” something like U.S. bailout recipient, Goldman Sachs.

When Temasek was founded in 2002, its portfolio “was largely concentrated in Singapore,” said Temasek chairman S. Dhanabalan.

read more

He's the quiet Chip on BHP Billiton's shoulder

A mine can last as long as 50 years, so mining executives plan their investments far into the future. As part of his own personal investment in the future, BHP Billiton's chief executive, Charles Goodyear, is sending his two children, aged 10 and 11, to Shanghai this year to study Chinese.

China's rapid economic rise, according to Goodyear, is creating the kind of surge in demand for commodities like copper, iron ore and oil that comes, perhaps, once in a generation.

That boom has helped Goodyear, in less than three years at the helm of BHP Billiton, to steer his company to record output and, this year, to the largest annual net profit ever earned by an Australian company, $US6.5 billion ($8.6 billion).

read more

Chip Goodyear

On February 6, 2009, Temasek Holdings, which had a portfolio worth 185 billion Singapore dollars ($123 billion US dollars) at the time, announced his appointment as a Board member and CEO-designate, to commence on March 1, 2009, succeeding Ho Ching from October 1, 2009.

He was identified as a possible candidate for the top office in Temasek in 2007, when the Temasek Board began reviewing internal and external CEO candidates since early 2005. Goodyear would have been the first foreign executive to run the Singaporean sovereign fund company, however, on July 21, 2009, the Temasek Board and Goodyear announced that they had mutually agreed that he would not be taking over as CEO, citing differences in opinions on strategy. Instead,

Ho Ching continued in the position, while Goodyear stepped down on August 15, 2009

read more

I asked Ho Ching to enter politics: Goh Chok Tong

Singapore’s Prime Minister Lee Hsien Loong and wife Ho Ching leave after an audience with Brunei’s Sultan Hassanal Bolkiah at Nurul Iman Palace in Bandar Seri Begawan October 5, 2017. (PHOTO: Reuters)

Emeritus Senior Minister (ESM) Goh Chok Tong has revealed that in the early 1980s, he approached Ho Ching to enter politics – but was told that the timing was wrong.

In the first volume of his newly-released memoirs entitled Tall Order: The Goh Chok Tong Story, Goh, who was Prime Minister of Singapore from 1990 to 2004, recalled that he had spotted Ho in the Ministry of Defence and thought that “she had the intellect and the attributes we were looking for”. “She would have made a good minister, a different kind of minister.”

Ho, who is now chief executive of Singapore sovereign wealth fund Temasek Holdings, was in her late 20s at the time. “She did not say no. She said not at this stage. She was still young.”

read more

Do you agree with ESM Goh that Ho Ching would have made a good minister?

A book about Emeritus Senior Minister Goh Chok Tong is making waves lately with its many revelations about various prominent figures.

One such revelation was that Goh, in the early ’80s, had approached Ho Ching – while she was working in the Ministry of Defence, and before she married current Prime Minister Lee Hsien Long – to join politics. Ho Ching is currently CEO of Temasek Holdings.

Goh had thought “she had the intellect and the attributes we were looking for”, adding that “she would have made a good minister, a different kind of minister”. She did not say no, but rather, not at [that] stage.

read more

In approaching Ho Ching for politics, has Goh breached his duties as cabinet minister?

To me, the aspiration to hold political office should be a calling. As such, I never really understood or agreed with the ruling Peoples' Action Party's (PAP) practice of handpicking people who have not been involved in politics to join the party and run for office. If you want to get people who have hitherto not been involved in politics to join the political scene, you would have to entice them to join. They may have to leave their existing jobs and to get them to do that - wouldn't you have to sweeten the deal? This is perhaps why our current Members of Parliament (MPs) and ministers are paid so well. Arguably, some were not really interested in political office to begin with and only joined the fray because they were invited to and perhaps made attractive offers? Are these the right type of candidates?

I don't query the intellect of those who have been handpicked. That said, having a high intellect does not necessitate to being a good MP or minister. A good MP or minister needs to have more than intellect, he or she needs to have empathy, desire and passion to be involved in public service. My concern is that the system of handpicking people not involved in politics to join the party may attract candidates who are only in it for the money or prestige. This, in turn, means that the government has to constantly offer high remuneration as an incentive to otherwise uninterested people. Is this the best use of public money?

Former Prime Minister and current Emeritus Senior Minister Goh Chok Tong (Goh), has in his newly-released memoirs entitled Tall Order: The Goh Chok Tong Story, confirmed that this practice of inviting suitable candidates to join the firm. He revealed that "in the early 1980s, he approached Ho Ching to enter politics – but was told that the timing was wrong." He further said that Ho Ching "had the intellect and the attributes we were looking for”. This begs the question - What attributes are they looking for? It sounds rather vague doesn't it? We are left to speculate what exactly those attributes are. Is it a safe pair of hands that will toe the party line part of the desired attributes? Is what is best for PAP always what is best for Singapore as a country?

read more

ESM Goh reveals Ho Ching didn’t say no when first approached to join politics

read more

While all you guys are focusing on the salary and bonuses, what you guys missed is that our dear gov had removed ALL pension scheme from Singapore BUT kept it only for themselves.

Apparently, all ministers of more than 2 terms will get Full Pension till death. So you kick them out all you want, they will still be laughing all the way to the bank everyday till the end of their life.

I wasnt able to believe it when I was told about this, can someone please tell me I was wrong

read more

Sometimes I start doing an evaluation of my life.

Sometimes I start doing an evaluation of my life.

In one of those I came across the story of the racing driver, Michael Shumacher.

When I studied his resume as an athlete I saw that he was:

Winner of the Grand Prix in 1991.

He was 7 times world champion of Formula 1.

Happiness was in his Being, but on a fateful day his story and his destiny completely changed due to a ski accident.

Today, just 44 kilos of weight struggling to "survive" since December 2013.

His wife begins to sell the goods to cover the expenses and thus be able to keep him alive in a room adapted in his house, where he lies like a vegetable.

Here comes a question:

Who is better than who?

Life can take directions never imagined.

It's amazing how everything can change in an instant.

No one is exempt from anything.

And in no circumstances are they of any use:

Money,

Titles,

Fame,

Success,

Power.

We are all the same.

Then why the pride?

Why the arrogance?

So why so much attachments to material goods and wealth?

All we have is the day to day so that we can live it with passion and happiness, doing good, serving our God, our family and neighbors with full of Joy and Gratitude.

We need to stop creating problems, claim insignificant things, and always avoid everything that "takes our time and lives".

Be careful not to lose someone who loves you and accepts you as you are.

As in the game of chess, in the end both the King and the Pawn are kept in the same box. In the end, we will all meet our end the same way.

It is worth examining what we have done or not yet do.

We are born without bringing anything. We die without taking anything, absolutely nothing!

And the sad thing is that in the interval between life and death, we fight for what we did not bring and even more for what we will not take. Think about that.

Let's live more, let's love more. Let's always understand the other and be more tolerant.

I wish we never forget that to be great *You have to be humble*.

Firing an Employee Is Hard to Do. Even a Bad One

It's a tough decision to let someone go from your company. But when you get to the point of making that decision, you may be too late. You gave second chances, you tried to get the person to come around, and you stayed positive until that point that pushed you over the edge. Then you said to yourself, "I should have let the person go months ago."

Here are some more things to remind yourself - the damage waiting can do in this situation:

If you're thinking that you need to rid your company of someone who isn't a fit, it's probably too late, so just do it and allow everyone to move on.

read more

related:

Temasek, the investment company owned by the government of Singapore, has issued a response to what it called a "divisive, racist campaign" which also involved "false claims". Temasek said that some of its employees from India had been "targeted" on social media, in a statement posted on its website on Aug. 14.

Temasek said that it had referred the offending posts to Facebook, citing "clear breach of their own community guidelines on hate speech". It said that it would "continue to press them to be more active in stamping out such hate speech, wherever it occurs on their platforms."

It did not mention the allegations made in the posts, although The Straits Times reported that Facebook posts circulating in recent days had called attention to the LinkedIn profiles of Temasek employees, questioning why top positions in the firm were not filled by locals.

read more

Temasek – Our People, Philosophy and Policy

Some of our colleagues from India have been targeted recently on social media by a divisive, racist campaign. This makes us very angry at the false claims perpetuated. The Singaporeans among us are also ashamed at such hateful behaviour on the Singapore social media.

We stand by our colleagues who have been dragged into this through no fault of their own.

We know that the social media can be a force for good or bad. We believe there is a role for constructive debate and fact-based opinions in our society, even on contentious or sensitive topics, and even on social media. That should be balanced with civility and respect for others. There is no place whatsoever for racism to feature in these debates. Insidious posts designed to stir hatred and intolerance have no place in our society, and we denounce them.

read more

Govt directs Pofma office to issue 4 correction directions for ‘false statements’ over Ho Ching’s Temasek salary

In a media statement on Sunday (April 19), the Pofma office said that the correction directions were issued to HardwareZone user “darksiedluv”, The Temasek Review's Facebook page, The Online Citizen's Facebook page and website, as well as opposition leader Lim Tean

Deputy Prime Minister Heng Swee Keat, acting in his capacity as Finance Minister, has instructed the Protection from Online Falsehoods and Manipulation Act (Pofma) Office to issue four correction directions over what the Office said was a false statement about the remuneration of Temasek Holdings' chief executive officer Ho Ching.

In a media statement on Sunday (April 19), the Pofma office said that the correction directions were issued to HardwareZone user “darksiedluv”, The Temasek Review's Facebook page, The Online Citizen's Facebook page and website, as well as opposition leader Lim Tean.

The Pofma office said that there were “false statements of fact contained in a number of social media posts on Facebook and HardwareZone Forum, as well as an article on The Online Citizen website”.

read more

Temasek Refutes Claim Ho Ching Makes S$100 Million a Year

Temasek Holdings Pte denied speculation that Chief Executive Officer Ho Ching makes S$100 million ($70 million) a year

“This claim is false,” the Singapore state investor said in a rare statement addressing the pay of the top executive, who’s also Prime Minister Lee Hsien Loong’s wife. “Furthermore, Ho Ching’s annual compensation is neither the highest within Temasek, nor is she amongst the top five highest-paid executives in Temasek.”

Temasek manages a portfolio that’s valued at S$313 billion as of March 2019. It’s the biggest stakeholder in half of the country’s 10 largest companies by market value, including flag-carrier Singapore Airlines Ltd. and DBS Group Holdings Ltd., Southeast Asia’s biggest lender.

The company issued a response following “chatter based on an Asian talk show commentary,” it said. It reviews compensation practices across the financial industry annually, according to the statement.

related: Singapore PM’s Wife Defends His Seven-Figure Pay on Facebook

read more

Remuneration packages given to top managements at GIC and Temasek not interfered by the Government – Lawrence Wong

On Wednesday (8 May), Second Finance Minister Lawrence Wong said in Parliament that the Government keeps an “arms-length relationship” with GIC and Temasek Holdings, and does not get involved in their operational decisions, such as remunerations

Mr Wong, who is also Minister for National Development and sits on the GIC’s board of directors, was responding to Workers’ Party Member of Parliament (MP) Png Eng Huat, who asked if there is a salary cap for key management of companies like sovereign wealth fund GIC and state-owned investors Temasek Holding. The Minister did not reveal the salaries of the top brass at the two firms, and added that instead the Government expects the Boards to hold accountable for their respective performances.

Mr Png had specifically requested for the range of total annual remuneration – which include salary, annual and performance bonuses – of the top three highest-paid executives at GIC and Temasek Holdings over the last five years. As such, Mr Wong noted that remuneration falls on performance and industry benchmarks, and supports a “prudent risk-taking culture”. In addition, a part of the remuneration at both companies are also tied to long-term performance. Further pushing for figures, Mr Png said, “These two entities are managing our reserves, and the Government is the sole shareholder. Usually shareholders would know the remuneration packages for the companies they own.”