What You Need To Know

Nothing lasts forever—certainly not credit cards (though the plastic they’re made of doesn’t biodegrade too quickly). Here’s what any cardholder should know about credit card expiration dates:

- An expiration date on a credit card is simply the date on which the card itself will no longer work and must be replaced. For cardholders, it doesn’t mean the actual credit account will cease to exist, it simply means you’ll need a new piece of plastic from the bank. Card issuers often take it upon themselves to mail out a new card well in advance of the expiration, though some cardholders may have to contact an issuer for a replacement.

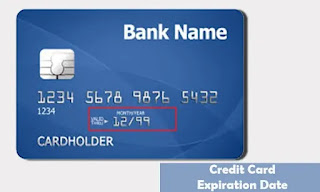

- Expiration dates appear on the front or back of a credit card in a two-digit month/year format. Credit cards expire at the end of the month written on the card. For example, a credit card’s expiration date may read as 11/24, which means the card is active through the last day of November 2024. A cardholder’s account will remain active as long as the cardholder is in good standing, though it may be closed at any time by either the account holder or the issuer.

- Expiration dates appear on the front or back of a credit card in a two-digit month/year format. Credit cards expire at the end of the month written on the card. For example, a credit card’s expiration date may read as 11/24, which means the card is active through the last day of November 2024. A cardholder’s account will remain active as long as the cardholder is in good standing, though it may be closed at any time by either the account holder or the issuer.

- After a credit card expires, it will no longer be possible to use it to make purchases. The card won’t work in stores and with online purchases and will return a “declined” notice from the bank.

- Most credit card issuers automatically mail cardholders a replacement card 30 to 60 days before the card’s expiration date. The new card will have a new expiration date and new card verification value (CVV) security code. Unless the account is upgraded or product changed, the credit card number usually stays the same.

- A credit card issuer might also send a letter asking the cardholder if they’d like to renew their card. The card issuer then has the option to reevaluate an account before they send out a new card. This might happen if the cardholder is in poor standing or has ceased using the account, in which case the issuer may decide to terminate the relationship and not send a new card as a result).

- Credit card expiration dates can feel like a hassle, but they have some specific benefits. Not only do they provide a shiny new card in the mail, they also help ensure a card is always in working order when you set out to use it and provide critical protection against fraud. Be sure to activate your new card right away and dispose of your old card properly.

What Happens When Your Credit Card Expires?

Today, you will be hard-pressed to find a consumer who doesn’t have at least one credit card in their wallet. When used properly, credit cards can be an excellent tool for building a strong financial future. However, credit cards have an expiration date, which is one aspect of having a card that some people find bothersome or confusing. Here is a look at what happens when your credit card expires, and the things you should look out for as a savvy consumer.

Credit cards have expiration dates for several reasons. The first is to allow for normal wear and tear of the physical card. (Only the card itself expires, not the credit card account.) The chip on the card can become worn, and plastic can break. So at certain intervals—typically every three years—your credit card company will send you a new card.

The second big reason is fraud prevention. Whether you’re using the card in person, over the phone, or online, the expiration date provides an additional data point that can be checked to make sure the card information is valid and you are the legitimate user.

Other reasons for expiration dates: They present the card issuer with a marketing opportunity and a chance to periodically re-evaluate the terms of the credit card based on your current creditworthiness. Card companies also may use the expiration date as an opportunity to send you a card with an updated design or logo.

Credit Card Expiration Date: Methods To Check & Important Facts

Credit Card Expiration Date is displayed on the front side of the credit card in (MM/YY) format. Interpretation :

- It informs the credit card owner about the expiry date of the card i.e. the month, past which card will be declined for all kinds of transactions from the bank end.

- Most banks allow card users to use credit cards until the month-end mentioned on the card.

- In most cases, banks themselves send a replacement card before the credit card expires.

Alike debit cards, credit cards also have an expiration date. Printed on the front side of the card, it is crucial to verify the card’s authenticity. In other words, it is another security feature. Post credit card expiry, card renewal becomes a must, if you wish to continue using the service.

Important facts about Credit Expiration:

- Post credit card expiry, credit card accounts are still operationally active, provided card owner has not given any instructions to close it.

- Expiry Date being a security feature is embossed on credit cards to counter any fraud attempts. It is like an additional protective layer which both merchants & retailers use to authenticate the card.

- Wear and tear happen to the card with time, rendering them unusable. This is also a reason behind introducing the concept of expiry date in credit cards.

- Technological upgrades happen at a revolutionary speed, making old cards operating tech obsolete, i.e. why a credit card cannot have lifetime validity. So, to keep them apprised with the latest technological advancements expiry date plays a crucial role.